Economics: Now, Future and Crypto

Part 1: Today's economy

Part 2: The economy of the future

Part 3: Crypto, the money of the future

ECONOMICS: CRYPTO

![]() Marius Amundsen. May 25th, 2022.

Marius Amundsen. May 25th, 2022.

What will the money of the future look like? Will there be a lot of different money or a dominant one? Will it be a central or a shared responsibility? Will humans or machines make decisions? Do you want stable purchasing power, increasing purchasing power, declining purchasing power or something else? Fixed money supply or flexible money supply? Instruments such as inflation as guidelines? The questions are many, and the answers few. The unknown is both exciting and scary. No one wants to go backwards, but the risk can be tempting if the payoff is large enough. With internet, digital money came one step closer. Although the rewards are great, it has been difficult to make digital money. So far, many have failed, but it is one project that has come further than all others. This is Bitcoin.

Bitcoin

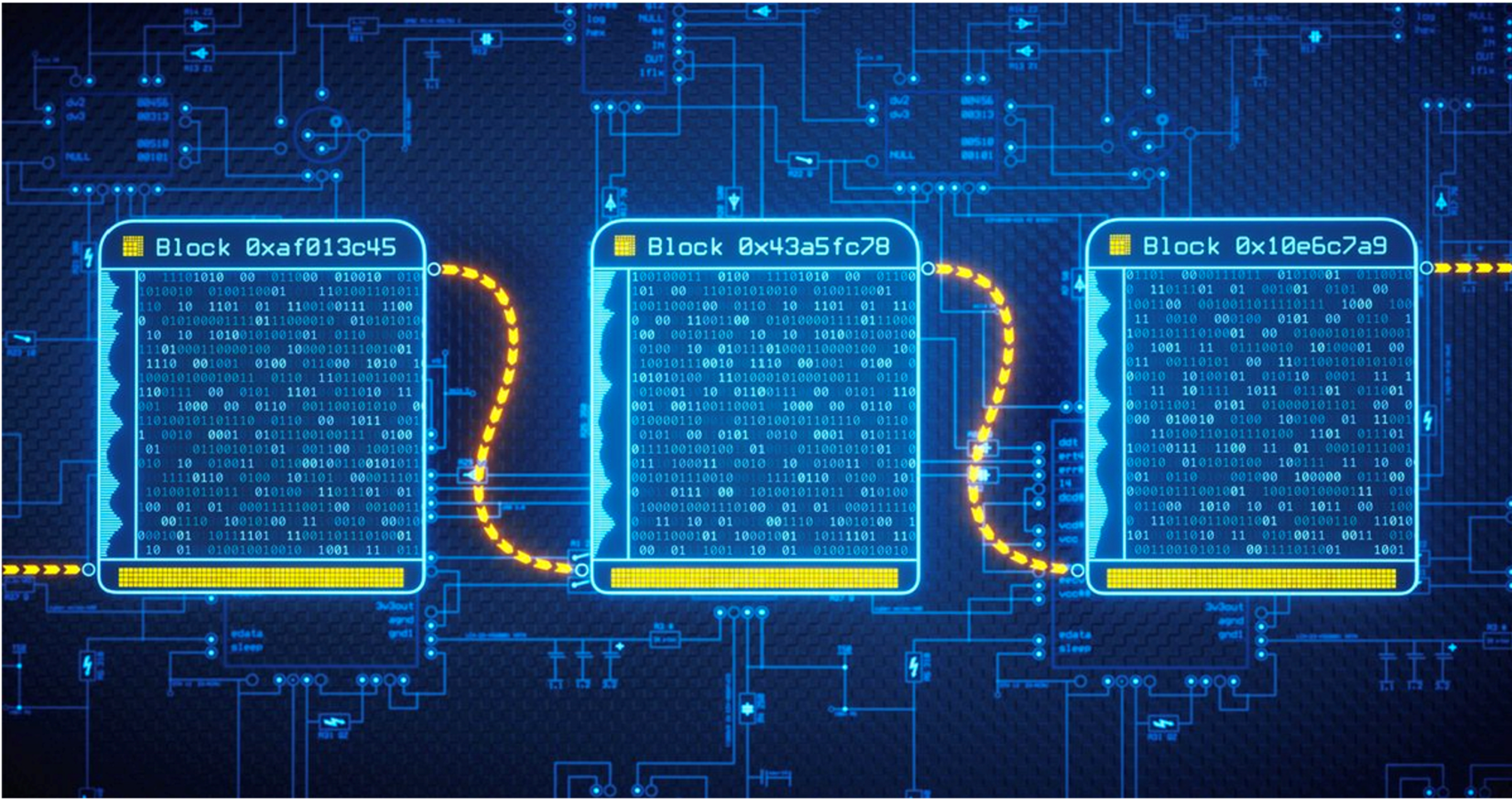

When Bitcoin was created, several new technologies were invented. The heart of Bitcoin's technology is blockchain. This is a way to store data securely and open, so that important data are better protected. This may not sound revolutionary. This is because you take for granted the benefits of ownership. Today paper still works as proof, but the downward trend is clear. When you get on the plane and have to show a ticket, it is now digital. Should you sign an agreement with the bank, it is also digital. This is proof and functionality associated with something that is in your possession(ownership). You might be thinking why blockchain, what does the bank and the train-ticket do wrong? The fault lies in the strength of the ownership, ie the bond between the asset and the unit that is the owner. The ownership today is good with the bank, but there is something better. If you want to get from A to B, the car is good, but flights are better. The big advantage of blockchain is that the ownership can be public and secure, which substantiates the ownership.

"The first thing (in credit) is character… before money or anything else. Money cannot buy it." —

JP. Morgan.

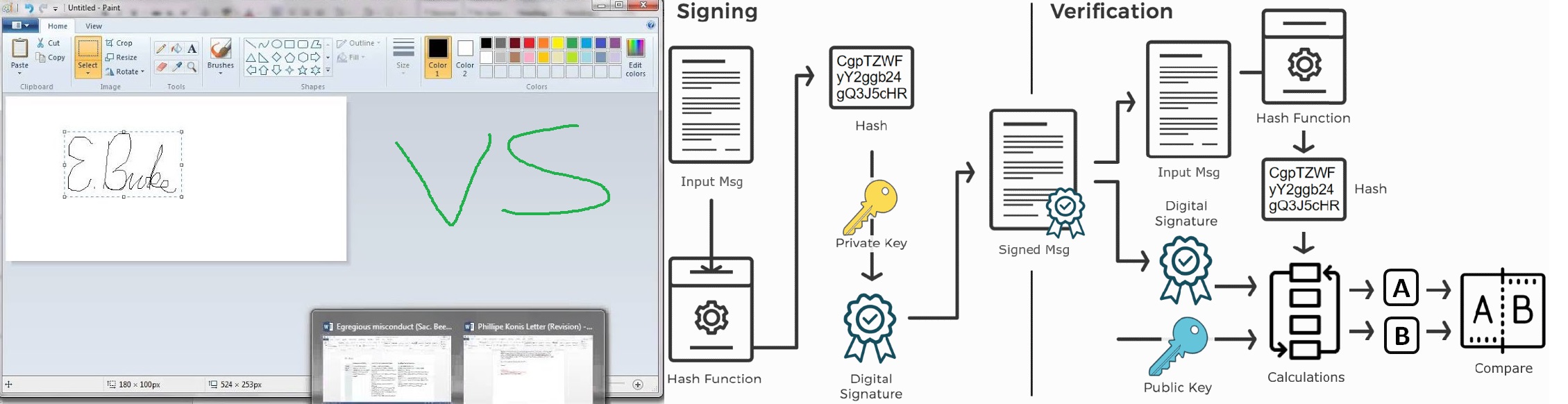

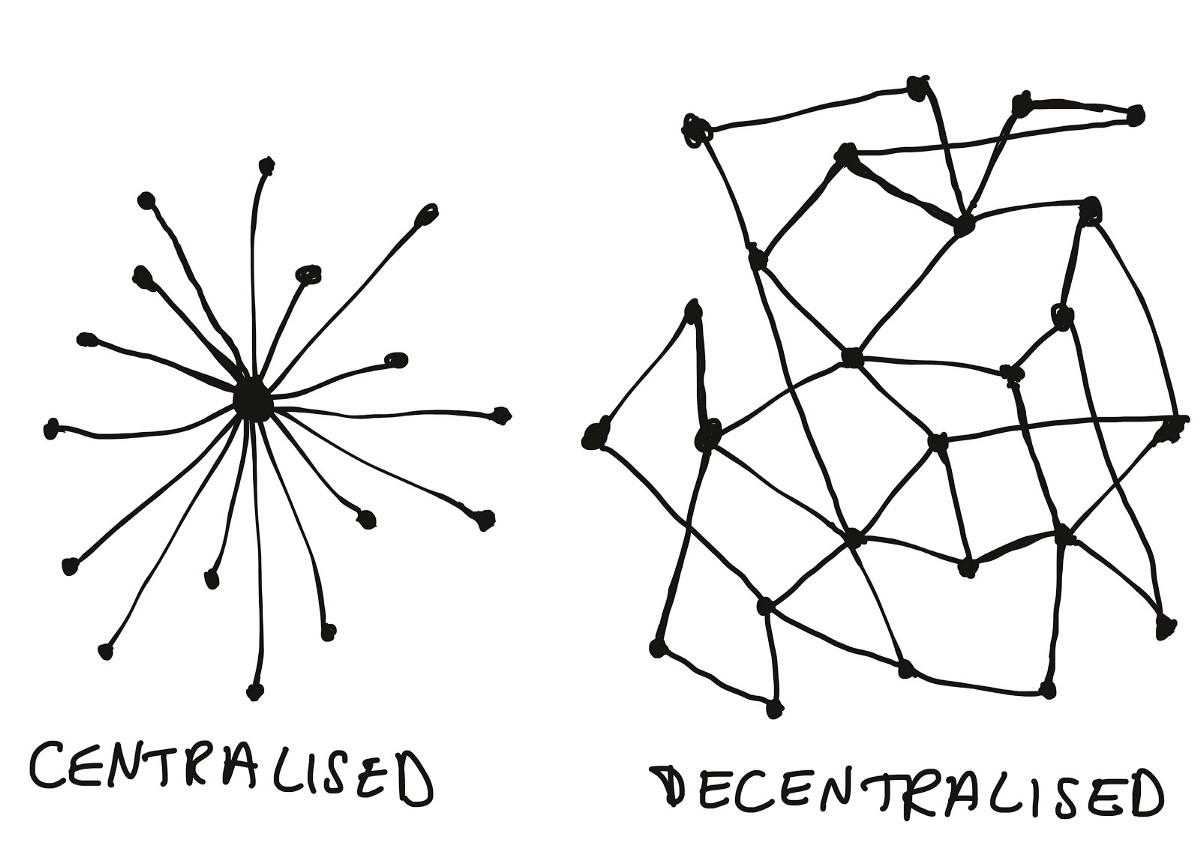

Old vs new signature technology

Not only can the ownership of the tokens be public, but the entire system can be public. That is, the responsibility to keep the system up lies with everyone. Because the responsibility lies with everyone mistakes will not be as critical. This also attracts smart people that want to make an impact. By sharing responsibility, the burden becomes easier to bear. This is at the heart of the crypto community that embraces decentralization. The strongest forces in crypto are not enthusiastic about centralization. However this is something that systems before have experienced, maintaining decentralization is difficult. Bitcoin's consensus mechanism "proof of work" is designed to underpin a decentralized system. But has already received several scratches in the paint by centralization of mining power. The financial incentive for miners in Bitcoin reduces the vulnerability by centralization. This is because those who account for a majority of miners and hence centralization, are those who earn the most and want to protect the system. This can be a compromise, and a necessary evil. Quite similar to today's finance system.

I drew this myself. You’re welcome.

The shared responsibility becomes strong with open source. The code is open to everyone. Everyone can change, edit, verify and contribute to the development.

The entire project can be copied and changed as desired. With small changes in a new project, a competitor is created, which is called a fork, and this has happened many times.

This is how many crypto projects are created, which are optimized towards different goals. The viable projects survive, but many do not. This demanding

environment drives crypto forward along with the high rewards. If the problems of inflation and security in traditional finance continues, the gains will probably

increase. Which means that more and more smart people are turning their attention to crypto. To an already competent and large community.

Crypto will be a new start. This is new technology and new money, which starts without debt. Distributed to those who take the risk first. A system too far into a debt spiral

can not be saved. As fiat currency is today, it is a matter of time before the debt can not be repaid and people become aware of it. When this perception spreads

fiat currency will potentially lose its value fairly quickly. This is a vicious circle, and a self-fulfilling prophecy when set in motion. That crypto starts with blank sheets

seems tempting to those who are early in. That the technology provides better security features and upgraded functionality is a bonus. When the boat sinks we do not need

fancy lifeboats, but it doesn't hurt either.

As I see it, blockchain was created as an underlying technology for crypto. Where Crypto is an underlying technology for Bitcoin.

When the boat sinks, the captain will optimally save the people, at any cost. Of course, it is not desirable to create panic, but at some point the captain must say that the boat sinks so that the evacuation plan is put into use. If the captain feels that the ship can be saved, the situation becomes very demanding. The crew can not leave the ship if the ship is to be rescued, which puts the risk of the ship against the risk of the crew and people. In such a situation, one must hope that the captain knows best, and takes the right decision. If the ship can be rescued and an evacuation plan is initiated, it can put the crew at higher risk than necessary and a preservation of the ship would provide.

Money is power, man seeks power. This is the biggest challenge associated with crypto. People have great difficulty letting go of power. With introduction of crypto, a major shift in power will take place. This is not going to happen painlessly. Not only within the population, where the balance of power will change and create problems. On the international stage, there will be a shift between nations, which can lead to conflicts. Those who are least locked in debt will most easily be able to switch to crypto, and indirectly weaken debt. Countries with little developed financial system, and therefore relatively little debt can have an advantage. This can therefore turn upside down on the economic situation internationally. Which will be in stark contrast to the military capacity, which is potentially a new problem.

Marius Amundsen

Want more information about crypto?

Sign up for a practical course here.