Economics: Now, Future and Crypto

Part 1: Today's economy

Part 2: The economy of the future

Part 3: Crypto, the money of the future

ECONOMICS: FUTURE

![]() Marius Amundsen. May 25th, 2022.

Marius Amundsen. May 25th, 2022.

The handshake has long been the physical sign that an agreement and a collaboration have been agreed upon. You stand in front of another party and reach out your hand, when eye contact is achieved take a firm grip with the right hand and equal attachment. For 3 seconds, the contact is held both by the hand and by the eyes. The eyes called the window of the soul, gives a signature to the agreement. The fact that there is no break in eye contact or signs of uncertainty, act as a last check. This practice has in recent years become less and less used, for various reasons. The main reason is the digitization of contracts. Which is natural considering the amount, speed and distance deals today represent. A number of methods have been tested for signing digital contracts. For example sign an agreement and then digitize it. There has been a longing for a natural way to digitally sign a digital contract. That take advantage of all benefits that comes with digitization. With the introduction of digital signatures backed by cryptography, smart contracts backed by blockchain and digital money backed by scarcity. Are we set for a digital handshake.

Digital handshake

In the future, transactions will be several, faster, cheaper, longer, larger, smaller and safer. Digitization has led to completely new ideas about what money is, and can be. And also who (or if anyone) needs to manage money. There will probably be many different alternative currencies that are optimized for specific purposes. Some are extra cheap, others super secure and some store purchasing power well over a long period of time. Some money has a transparent nature and are decentralized. Others are centralized and closed by nature. The possibilities are enormous, and many attempts will fail before we create star money.

"The first thing (in credit) is character… before money or anything else. Money cannot buy it." —

JP. Morgan.

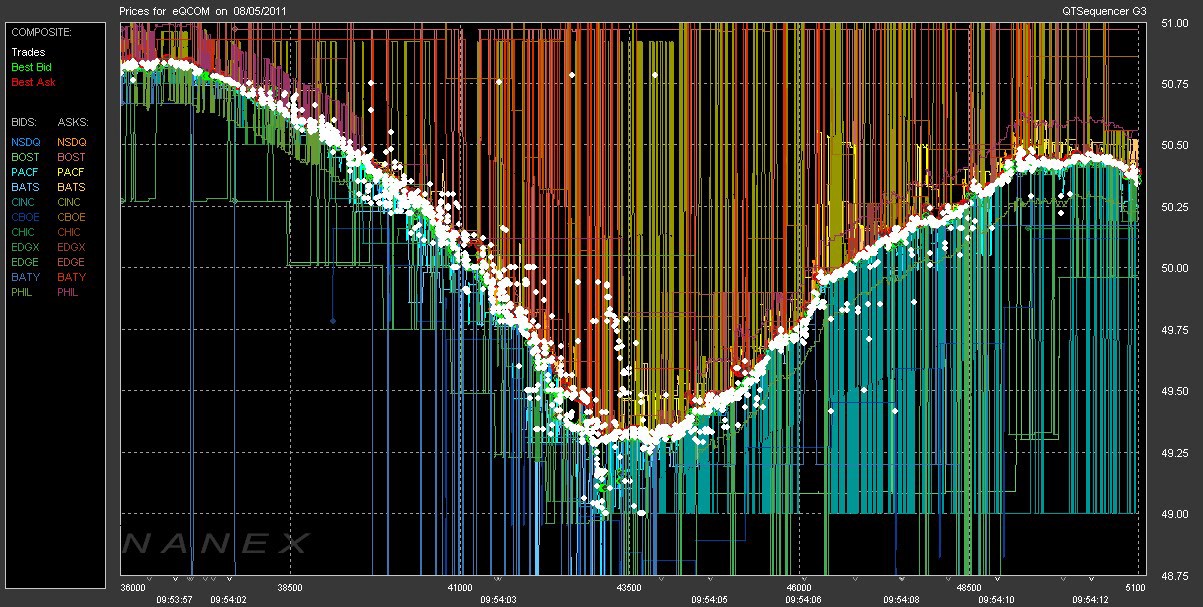

High frequency trading

The authorities use the power that comes from managing money. As mentioned, the bond between the authorities and the central banks have become closer. And they influence each other. There may come a time when this power is both utilized to a greater extent, and removed. A large public sector is costly, and the government takes a lot of responsibility in such a case. Being open about costs and revenue is critical so that unnecessary mistakes are avoided. When mistakes are made, the responsibility must be distributed in a fair way. With hidden deficits from use of creative finance, it often results in increased money supply, reduced purchasing power, price growth and inflation. In the extreme case where inflation gets out of control, it can destabilize both money and the government. By smaller authorities, the responsibility will to a greater extent lie with the individual.

Creativity over Intelligence

Working life will continue to develop significantly, and jobs will to a greater extent be a privilege. First took machines heavy work, then they took precision

work, now they are in the process of taking the intellectual work. Man now works less than ever. Shorter days, shorter weeks, more holidays and "easier work".

Human creative qualities will in the future become more important and more sought after, since this is something machines can not do. It seems natural that

man is going to evolve with the competition from machines. So that the individual becomes stronger. Enormous amounts of information are open to everyone, via the internet.

Creating a lot of opportunities, and potentially a lot of jobs. As more power and technology become available, the need for work will continue to evolve. The social structure

that today is well centered around the status associated with your profession will also evolve. Status associated with work will still continue, but be redefined.

A redefined economy with a different relationship towards debt provides opportunities and challenges. When the artificially low interest rates the West has seen can no longer be supported, will the market take over. This will lead to a market driven interest rate which according to historical conditions, will be significantly higher. The interest rate reflects risk, which often is high. Without high inflation, debt becomes less attractive. Those who lend debt will probably act more aggressively. This can lead to more conflicts. With less debt and harder money, the market will become more sensitive and responsive. A market that makes artificial high or low prices becomes less likely, since such mispricing becomes more costly.

Marius Amundsen

Want more information about crypto?

Sign up for a practical course here.